Welcome to Part 4 of this series, where I am focusing solely on the “Instant Funding” products, available at only a few funding companies.

It’s typical to find standard evaluation accounts at each of the companies I cover on this site, but there has been a recent uptick in the number of direct/instant funding accounts as well. It’s likely that more companies are on the way.

In this installment, I compare all of the options so that you can make the best choice for you. Unlike the previous parts to this series, this time I’ve included all of the relevant information for each company on a single page. Since there is no evaluation period, costs and rules are a bit simpler with these accounts, and there’s less to explain overall.

Why Direct Funding?

As mentioned earlier, the direct funded accounts allow users to go straight to the funded phase, without being evaluated on their skills first. The accounts are more expensive, which serves as a barrier against the most undercapitalized traders. So who are these accounts for?

I suspect that these companies have discovered that there exists a market of traders willing to pay a little more money to trade without the personal risk.

And why not? The greatest challenge in day trading with leverage is protecting your personal capital from a horrible trade or streak of trades. To remove this risk is the biggest advantage of the funding process, and direct funding makes this advantage even easier to access.

The greater cost can be an obstacle, and the traditional path with an evaluation is not difficult if you have a good strategy. Saving the money makes more sense for some traders (including myself), and it may be bad for your discipline to have the ability to acquire a second funded account immediately after failing your first.

If a trader is not experienced, they can expect to lose quite a lot of money by blowing multiple funded accounts in this way. But if they have confidence in their strategy, it is quite a deal. Just a few years ago, you’d never get to trade 5 full contracts (or more) for a couple hundred dollars, without even proving your profitability first.

But as I’ve suggested in the past, don’t rush into this. Read the rules carefully, and review the general rules for funded accounts in previous posts if you aren’t familiar. Concepts like the Trailing Drawdown, Daily Loss Limit, Consistency, or others will be mentioned here but not explained again.

Apex Trader Funding

Apex Trader Funding‘s CEO Darrell Martin has hinted at Apex providing direct funded accounts in the near future. The rumors are that the only sizes offered will be $50,000 and $250,000 to start.

More information will be provided here when these accounts are officially available.

FuturesElite

Futures Elite offers three levels of instant funded accounts.

| Futures Elite IFAs | Contracts | Drawdown (EOD Trailing) | Cost (one-time fee) |

|---|---|---|---|

| $50,000 | 5 (50 micros) | $2,250 | $499 |

| $100,000 | 10 (100 micros) | $4,500 | $699 |

| $150,000 | 15 (150 micros) | $6,000 | $899 |

Effectively, you are paying for about 4-6 times your money in drawdown when you sign up for an Instant Funded Account at FuturesElite.

Withdrawing Profit

You have to reach a couple milestones to begin withdrawing profits.

First, you need to have at least 7 trading days, in a period of 14 calendars for each payout. There is a minimum profit requirement for a session to be counted as a trading day.

Second, you must reach a 5% withdrawal threshold, which remains in the account during payouts. After the third payout, this buffer can be accessed by the trader.

Third, there is a cap on the maximum amount eligible for withdrawals. See the table below.

| FuturesElite Withdrawal Requirements | Withdrawal Threshold | Profit Per Day | Withdrawal Cap |

|---|---|---|---|

| $50,000 | $2,500 | $100 | $2,500 |

| $100,000 | $5,000 | $200 | $3,500 |

| $150,000 | $7,500 | $300 | $4,200 |

Consistency

In addition to meeting these requirements, there is a consistency rule of 20% – no single day’s profits should exceed 20% of the total. This is a strict rule, as the lower the percentage, the more your profits must be spread out, and the more you get penalized for runners. 20% is one of the most difficult you’ll find in the industry.

With these requirements, you can withdraw no more than $12,600 in the first 3 payouts, which would take a minimum of six weeks.

Compared to other direct/instant funded accounts, not having the cap removed is a major hurdle.

Profit Split

Here the Profit Split starts at 80/20, but increases to 90/10 after 5 consecutive payouts. After the 8th payout, the split increases to 100/0, which suggests that FuturesElite will be making money through copy trading rather than a cut of your profits.

Lucid Trading

Lucid Trading offers two direct funded accounts, shown below.

| Lucid Trading Direct Funded | Contracts | Profit Target | Drawdown (EOD Trailing) | Static DLL | Cost (one-time fee) |

|---|---|---|---|---|---|

| $50,000 | 4 (40 micros) | $3,000 | $2,000 | $1,200 | $489 |

| $150,000 | 10 (100 micros) | $6,000 | $6,000 | $3,600 | $699 |

Account Rules

Lucid Trading has one of the more lenient systems when it comes to rules on the funded account. Traders can trade news, scalp, DCA, copy trade, and do just about anything besides abuse. Abuse includes the usual things like hedging or microscalping.

Withdrawing Profit

For the direct accounts, it’s slightly different from the Lucid Pro accounts.

20% Consistency Rule

Instead of earning a certain dollar profit for 5 trading days, you just need to follow a 20% consistency rule. This automatically implies that you must have at least 5 profitable trading days, because it would be impossible to get your consistency under 25% with 4 days or less.

Withdrawal Threshold and Payout Limits

Note that to withdraw from the $150,000 Direct account, you need to achieve almost twice as much profit ($9,000) as in the $150,000 Pro account ($4,600).

| Lucid Direct Accounts | Withdrawal Threshold (Payout 1) | Withdrawal Threshold (Payouts 2+) | Max (Payouts 1-3) | Max (Payouts 4-6) |

|---|---|---|---|---|

| $50,000 Direct | $3,000 | $2,500 | $2,000 | $2,500 |

| $150,000 Direct | $9,000 | $4,500 | $3,000 | $3,500 |

Fees

There are no fees on these accounts besides the initial cost at purchase.

NexGen Futures Trader

NexGen Futures Trader is a newer firm, that offers both evaluations and direct funded accounts (called Instant Funded Accounts). These accounts are designed as an intermediate step just before a live funded account. You can have 3 of these accounts (of any size) at one time.

One major drawback here is that they currently do not offer Rithmic – instead, you must use a platform called ProjectX.

| NexGen Futures Trader IFAs | Cost | Contracts | Profit Target | Drawdown (EOD Trailing) |

|---|---|---|---|---|

| $25,000 | $339 | 2 (20 micros) | $1,500 | $1,250 |

| $50,000 | $459 | 5 (50 micros) | $3,000 | $2,500 |

| $100,000 | $679 | 10 (100 micros) | $6,000 | $5,000 |

Account Rules

NexGen strictly forbids algorithmic/bot trading.

However, they have no rules against DCAing or for how you use stop losses. They say that you can trade however you want.

Maximum Loss Limit

Initially, the maximum loss on the account is set at 5% (values shown in the table above). The drawdown stops moving up once it reaches the starting balance of the account.

Withdrawing Profit

To request a payout, you must have at least 10 trading days since the previous payout. You must also meet a consistency requirement.

Consistency for Withdrawals

When requesting a payout, NexGen offers a 90/10 profit split. However, there is a consistency rule of 20% – no single day’s profits should exceed 20% of your total. If a trader exceeds 20% but manages to meet a consistency requirement of under 25%, they can still request a payout. The cost is taking on a ridiculous 50/50 profit split instead.

I’d recommend bringing your balance up until that single day is below 20% instead of sacrificing hundreds or thousands of dollars.

Minimum Profit Days and Withdrawal Limits.

During the 10 day (or more) period, at least 5 of these days must meet a minimum profit requirement, shown below.

| Account Size | Minimum Profit on 5 Separate Days | Withdrawal Limit |

|---|---|---|

| $25,000 | $100 | $1,250 |

| $50,000 | $200 | $2,000 |

| $100,000 | $300 | $3,000 |

Besides the consistency rule, there seems to be no cap on withdrawals.

Fees

Information on potential extra/hidden fees is unknown at this time, pending a response from NexGen.

Payouts are made via ACH/Wire only.

Check out NexGen Futures Trader here.

Purdia Capital

Purdia Capital offers multiple account types, which you can read about in the other parts of this series. There are no monthly fees. The process is as follows: you pay a single cost, get a Simulated Funded Account (SFA), and trade for as long as it takes to move to the Live Funded Account (LFA). Upon being moved to the Live account, you get to start withdrawing profits.

For their instant funded accounts, there are two options.

| Purdia Capital Instant Funding | Cost | Contracts | Drawdown (EOD Trailing) | Withdrawal Threshold (1st) | Withdrawal Threshold (2nd+) |

|---|---|---|---|---|---|

| $50,000 | $649 | 5 | $1,500 | $2,000 | |

| $100,000 | $999 | 10 | $3,000 | $3,000 |

Account Rules and Fees

As mentioned before, you begin in the SFA phase. Here, you are expected to do the following:

- Earn $3,000 in total profits

- Trade for at least 10 days

- Have at least 5 days with profits of $200 or more

- Stay above the EOD Trailing Drawdown

Profits that you earn during this phase are transferred to your live account once you qualify for the move. However, any profits above $3,000 are not transferred; in other words, don’t bother overachieving in the SFA.

Once you are in the LFA, you are trading on an actual live account – the orders actually go to the market and fills are not guaranteed the way they are on simulated accounts. You are only allowed to have one of these live accounts at a time.

In the LFA, there is a new Daily Loss Limit enforced. Regardless of the balance, you are not allowed to lose more than 33% in a single day. Upon losing this amount, your account is locked until the next trading day.

Fees

There are no data fees, platform fees, or other fees whatsoever.

Withdrawing Profit

The withdrawal process here is great. Once you get to LFA, Purdia Capital offers a 90/10 profit split, with no limits on withdrawals whatsoever. You can withdraw everyday, as little or as much as you want. There are no consistency rules, and because the max drawdown is static, it’s as close to having your own personal account as it gets.

However, when you get to the LFA, the drawdown becomes the initial balance + $100. So on the $100,000 account, your LFA will start with a balance of $3,000 and a max loss of $2,900. This also means that if you withdraw enough of those initial profits to make your balance hit this drawdown, the account will be closed.

Profits are withdrawn through direct bank transfer.

Scaling

While you can only have one LFA at a time, you have the opportunity to scale to higher contract sizes and daily loss limits, as you grow your account. This is done at the discretion of Purdia, so it would be assessed case-by-case.

Check out Purdia Capital here.

TickTick Trader

TickTickTrader offers three levels of “Direct Accounts”.

Users are allowed to have only one active direct account per tier at a time. So you can have a maximum of three direct accounts. These accounts cannot be reset.

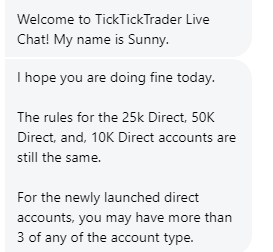

Recently, TickTick Trader also added the $100k, $150k, and $250k direct accounts (all are on sale at 50% off – use code DOJIDOJO to get the discount). These accounts are not counted toward the 3 account maximum limit, so you can have as many as you want (see Sunny’s message on the right).

| TTTDirect Accounts | Contracts | Daily Loss Limit (Soft) | Drawdown (Static) | Cost |

|---|---|---|---|---|

| $10,000 (Swing) | 5 (micros) | $350 | $1,000 | $229 |

| $25,000 | 4 (40 micros) | $500 | $1,500 | $349 |

| $50,000 | 10 (100 micros) | $1,250 | $2,500 | $699 |

| $100,000 (Core) | 10 (100 micros) | $2,500 | $5,000 | $629 (on sale for $315) |

| $150,000 (Prime) | 15 (150 micros) | $3,750 | $7,500 | $699 (on sale for $349.50) |

| $250,000 (Zenith) | 25 (250 micros) | $6,250 | $12,500 | $999 (on sale for $499.50) |

Account Rules and Fees

There are two soft rules here that will shut your trading down for the day: violating the daily loss limit, and trading more size than you are allowed. The scaling system is as follows (no scaling system for the $10k micros-only account):

| TTTDirect $25,000 Account | Profit Required |

|---|---|

| 2 Contracts | $0-$1,600 |

| 4 Contracts | $1,601+ |

| TTTDirect $50,000 Account | Profit Required |

|---|---|

| 2 Contracts | $0-$1,600 |

| 5 Contracts | $1,601-$5,000 |

| 8 Contracts | $5,001-$8,500 |

| 10 Contracts | $8,500+ |

The current account balance is what is used, including unrealized profits. Upon violation of this rule (taking on too much size before you can afford it), there are two warnings given.

The first two times, your account is simply blocked from trading the rest of that market session. If you break the scaling rule a third time, you lose the account.

Overnight Positions

If you happen to leave a position overnight accidentally, you get one warning. Your account can be reinstated by reaching out to the Customer Support, and is subject to review.

Instrument Limitations

Another unique rule here is that you cannot trade the same instrument across multiple accounts. This indirectly bans you from copy trading. It seems TTT does not want you to use multiple accounts to increase the size of your positions.

TickTickTrader explicitly states that DCAing, copy trading, and flipping are allowed (though flipping carries no advantages when there’s no trading days requirement).

Withdrawing Profit

TickTickTrader offers a profit split of 90/10, with all profits in the first 3 months going toward the trader. Payouts can be requested at any time during the month, and are processed within 5 business days.

There are no trading days requirements, consistency rules, or caps on withdrawal amounts. You can earn as much as you want for 3 months, keep all of it, and then start paying TTT a 10% cut after. But the safety threshold amount must remain in the account after each withdrawal.

| TTTDirect Account | Safety Threshold | Minimum Withdrawal |

|---|---|---|

| $10,000 Swing | $1,100 | $250 |

| $25,000 | $1,600 | $250 |

| $50,000 | $2,600 | $500 |

New Direct Accounts

For the 3 new, larger TTTDirect accounts, you are allowed to withdraw from the Safety net. However, there is a 20% consistency rule, which is restrictive compared to the usual 30-50% consistency rules we see elsewhere.

Payments are made via Wire Transfer and Cryptocurrency (USDT TRC20).

For a deactivated account, 20% of the sum exceeding the safety threshold goes to the trader.

Check out TickTick Trader here.

Tradeify

Tradeify is a newer firm that features 3 levels of Direct Funded Accounts.

Unlike other firms with a true live account, these accounts are Simulated Funded Accounts (SFAs). They mention that after three successful payouts, Tradeify reserves the right to move you to a live funded account at any time.

Traders can have up to 7 total Simulated Funded Accounts at once, regardless of size. This includes non-direct funded accounts as well.

Positions must be closed by 4:59 PM EST. Opened positions are automatically closed by Tradeify, so you won’t fail your account if you forget.

| Tradeify SFAs | Contracts | Daily Loss Limit (Soft) | Drawdown (EOD Trailing) | Cost |

|---|---|---|---|---|

| $50,000 | 5 (50 micros) | $1,250 | $2,500 | $549 |

| $100,000 | 10 (100 micros) | $2,500 | $5,000 | $629 |

| $150,000 | 15 (150 micros) | $3,750 | $7,5000 | $699 |

Account Rules and Fees

Outside of avoiding the EOD Trailing Drawdown, you have to worry about the Daily Loss Limit, and Consistency Rule. Because it’s a soft Daily Loss Limit, you are only blocked for the rest of the day if your losses reach the designated amount.

The EOD Trailing Drawdown stops moving up at initial balance +$100.

News trading is fully permitted.

Withdrawing Profit

Tradeify traders keep 100% of their first $15,000 in profits (per trader, not account), with a 90/10 profit split afterward.

To withdraw, you are expected to meet a few requirements. You must reach 10 trading days, following a consistency rule of 20%.

20% is much lower than the usual consistency threshold (30-50%) we find at other firms. This makes it more difficult to withdraw profits, if you are the type of trader who gets big runners once in a while.

Conclusion

As you can see, there aren’t as many options available as there are for traditional evaluation accounts. However, new firms are opening up more frequently, and the alternatives continue to grow.

If you’re opposed to the evaluation process, this is your best bet for trading futures without an evaluation. You will still have your personal funds completely safe by using these accounts, as long as you can afford the steeper cost.

Did I miss a company or a feature of the ones presented here? Let me know (we are usually fastest to respond on Discord) and I will be sure to update this post accordingly.

Leave a Reply

You must be logged in to post a comment.