The hammer candlestick is a single candle pattern in which the shape of the candle resembles a “T”.

Its name can vary depending on a few factors. If it takes place after an extended selloff, some may call it a dragonfly. If the body of the candle is so small that it has the same open and closing price, the term doji can apply. If it occurs after a bullish move, some call it a hanging man instead.

Traders label a small or no-body hammer candlestick with any of the following names: hammer, dragonfly, hammer doji, or dragonfly doji. These are all under the umbrella term, “hammer candlestick”.

In this article, I will explain everything you need to know about the hammer candlestick pattern. This is a powerful tool in determining where bullish reversals are about to occur, and something I use just about everyday.

How to Identify a Valid Hammer Candlestick Pattern

When the market sells off for an extended period of time, a hammer may form near the lows. This provides crucial insight into potential trend reversals. It is important for traders to understand the implications of such a candle under the right circumstances in the market. But first, a trader must know how to identify this candlestick.

There are multiple ways that traders determine whether a hammer is valid or not. There are also additional factors that traders can use to decide whether to place a trade using this candle. In most cases, traders are looking for two things.

1) The shape of the candle and the size of its wicks.

This pattern is simple because it involves only one candle. But the wicks are crucial in identifying a valid hammer, and increasing the reliability of the trade idea.

- The candle body is small and the lower wick is larger than the body.

- It has a small or no upper wick.

Some will say the size of the lower wick should be at least two times the size of the candle body. But there are times when price is moving in a tight range with lower volatility, creating a small lower wick.

As a trader gains experience, their judgment aids this identification process. Rather than seeking a strict 2:1 wick to body ratio, traders can gauge by the appearance of the candles themselves. For example, there may be good hammer candles with a 1.5:1 wick to body ratio. These hammers are often still considered valid based on other contextual clues.

The market’s volatility plays a factor as well, because a less volatile market will have less moves producing large wicks on average.

My suggestion is to not look for a strict ratio, but rather to train your eye to determine the valid hammers over time.

2) Existence of a significant pullback or downtrend.

Regardless of how traders interpret the shape of the candle, the value of this pattern comes from the correct application. When the market is in a downtrend and it produces this candle at relative lows, it is a powerful clue of a change in sentiment. Consider the two charts below.

This first chart is an example of a clear downtrend, with the market trading near recent lows.

On this chart, however, the price is moving mostly sideways, consolidating in a bullish trend. While the candle is still a hammer in shape, the validity of the hammer as a trade signal is greatly diminished.

You must not enter long strictly off of the candle’s quality in a vacuum. Without the appropriate context from the first chart, you can’t expecting a significant move higher on the second chart.

The Psychology Behind the Hammer Candlestick Pattern

The appearance of a hammer candle in a downtrend is a strong sign of rising bullish sentiment. The market began pushing lower, but then stopped at some point during that candle’s formation. Before the candle closed, price rebounded quickly, ultimately closing at or near the open price.

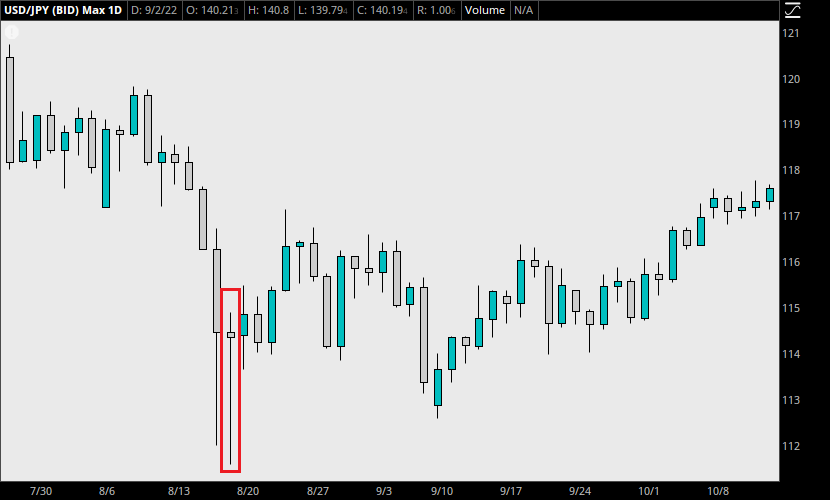

Sometimes, the lower wick on the candle is significantly larger than twice the size of the body. Take a look at the hammer in the box below.

When a hammer has such a large lower wick, it indicates a selloff followed by a strong reversal, both occurring within a single candle. Buyers took control somewhere along the bottom of the wick, and overpowered the sellers until the candle closed near the open, and sometimes even at the highs.

How to Increase the Reliability of a Hammer Candlestick

If the market is in a downtrend and this candlestick pattern appears, it may still not be enough of a reason to take a long position. Experienced traders do more than this to eliminate false reversal signals. Consider the following steps to achieve a higher level of performance.

1) Evaluate whether the candle itself is bullish.

Until now, there hasn’t been any mention of whether a hammer candle is typically bullish or bearish. This is because a bearish candle that has the right hammer shape can still be a powerful bullish signal, and vice-versa.

But you may want to be more selective than using the shape alone. Some traders opt to ignore the hammers that close bearish, passing up the trade unless the candle has a bullish close.

2) Wait for confirmation from the next candle.

Technical traders often choose to wait for confirmation as well. Before deciding to act upon a single candle pattern, traders want to see what the next candle does. They look for a hammer during a downtrend, as well as a bullish close on the subsequent 1-3 candles. While this results in smaller profits due to a later entry, it can increase the reliability of the overall pattern.

3) Combine the hammer with another candlestick pattern.

Another way to improve the quality of a single candle setup is to consider looking for other patterns that develop simultaneously with the hammer candlestick. Perhaps a trader wants the hammer to have the same closing price as its open price, forming a doji. Or they might look for another candlestick pattern that signals a bullish reversal along with the hammer.

For example, in the box below, a hammer candle developed after a significant pullback. But on the next candle, a bullish engulfing pattern forms. This kind of signal is far less common than a simple hammer candle, but also much more powerful. It provides an additional level of confirmation to enter a bullish trade, because both candles signal a bullish reversal individually.

How to Trade the Hammer Candlestick with Examples

Knowing that other traders consider the hammer candlestick pattern one of the most powerful bullish reversal signals, it’s a good idea to implement it in your entry or exit strategy. Rather than guessing where a trend may reverse, traders who understand the power of the hammer candlestick can enter or exit a trade with precision.

Example Trade

Look at the chart below. After judging that the market is in a downtrend, a trader notices that a bullish hammer develops. A stop loss below the wick offers a low risk entry on a long position.

Upon seeing the candle close, our trader enters long with 10 shares at the beginning of the next day. Their entry price is $160.60 per share. Going by the low of the hammer ($158.70), which is lower than the price action around it, the stop loss is placed at $158.00.

The market erupts immediately, running up to over $176 in the next two weeks. Depending on our trader’s profit targets, they may choose to either take profit or hold the position longer. Assuming they take profit somewhere around $175, we can see how this hammer signal produces significant returns in a short period of time.

Final Numbers

On an original investment of $1606.00, profit at $175 per share is $144, a 8.9% gain. With the stop at $158.00, this offers a risk-to-reward ratio of 1:5.5.

Other Implications of the Hammer Candle

Did you notice the horizontal line below the hammer in the chart above? This line depicts support that exists just at the low of the hammer.

Note what happened in October, about 2 months after the original trade was taken. Price came back to test the same level, and found strong support at this price. Not long after, the market continued to run, this time reaching over $187.

While some traders will take profits during the original run, others may have missed the initial entry. To capitalize properly on the second run, a trader must learn to be aware of significant support and resistance levels, such as the one in this example. The hammer forming at that moment helps to expose that strong demand exists at those prices.

Once the hammer formed and price began to explode upward, our more experienced trader takes the time to analyze the area around the reversal. By understanding the presence of support, resistance, and even trendlines, they can react to a second pullback appropriately.

Variations of the Hammer Candlestick

Because this candle can form at any time, there are several variations that have their own implications based on the market context. These variations are discussed in separate articles, which you can read about next:

- Inverted Hammer (bullish)

- Hanging Man/Dragon Fly (bearish)

- Gravestone/Shooting Star (bearish)

Leave a Reply

You must be logged in to post a comment.