Apex Trader Funding is one of the better prop firms available for futures traders. However, they have a… questionable style of explaining things in the documentation found on their site.

Due to what some may call word vomit, it makes their already complicated system even more complicated for the average trader. I imagine this turns a lot of potential customers off, because it is a bit of a headache to navigate all of the information without wanting to give up in the first 15 minutes.

If there is still any confusion after this guide, let me know and I will do my best to clarify it further for you.

- Why Even Use Apex Trader?

- Why Do I Consider Apex Trader Funding’s System Complicated?

- Avoid Payoneer, and Revolut When Using Apex

- Requirements for Payout Requests

- What Happens When Requesting a Payout?

- What Happens After A Successful Payout Request?

- Step by Step Guide to a Successful Payout Request

- Conclusion

Why Even Use Apex Trader?

Before we begin, you may wonder why I would bother with a firm that’s complicated in the first place, when there are other firms out there. I know there’s other options. I’ve written up a comprehensive analysis of all the major futures trading funding companies out there, which you can read about here.

However, Apex Trader offers something most firms don’t, which is the potential to manage up to 20 simultaneous accounts on one login, and the freedom to copy trade across each one. This provides a trader with the ability to earn significantly more profits than they normally would with their own capital or with most other firms.

If you take advantage of Apex’s sales, the cost per account is quite competitive as well. I wouldn’t call them the best firm due to their complicated and slow withdrawal system, but I do think they are one of the best choices available for those interested in scaling their operation beyond 5-10 e-minis.

Why Do I Consider Apex Trader Funding’s System Complicated?

First off, it’s all relative. I fully understand these firms now, and going through the process of getting funded and dealing with multiple withdrawal systems helped. But I know that newer traders would be perplexed navigating through some of these firms’ websites, especially Apex’s. Compared to other firms, Apex Trader places a few major restrictions on funded traders.

If you’re withdrawing profits, it’s not unlike some other prop firms. Most companies enforce rules to limit your initial withdrawal requests. This is done by requiring you to trade a number of days before you can get any money out, or having to leave some money in your account as a buffer. In this regard, Apex doesn’t do anything out of the ordinary.

When compared to firms like OneUpTrader, though, Apex is undoubtedly more difficult. If you’re one of the more talented traders who can generate significant profits (more than $10,000 per month per account), you will not be able to withdraw all of it in the first month.

For this reason, it’s important that you understand exactly what you will be signing up for, so you are not blindsided by these rules if you find yourself with a large profit in the first month or two.

Avoid Payoneer, and Revolut When Using Apex

Payoneer and Revolut are payment services that need to get their stuff together. According to Apex, payments done through these companies often get rejected, and they ask the account holder to provide extra documentation in order to release the payment.

Some people have had success using them, but many others have not. To be safe, avoid Payoneer or Revolut as payment processors, to save yourself a headache or two.

Requirements for Payout Requests

Before you can request a payout, you need to meet a few requirements. I’ve compiled them all here.

Trading Days Requirement

Apex requires you to have 8 separate trading days between each payout. You also need at least 5 of your trading days to show a profit of $50 or more.

30% Consistency Rule

This 30% rule refers to your profits – no single trading day should be above 30% of your total account’s profits at the time of a payout request. If you do violate this rule, your withdrawal request is denied.

This is a horrible rule for trend-following traders, even though it is employed by Apex to deter gambling. It means that you must either ease up on your funded account’s profits from time to time, or, even worse, get more aggressive on the days after you had a great trading day.

Again, if you’re able to make a big profit in one day relative to your 8-day gains, you will not be able to withdraw ANY of your money until you satisfy the 30% consistency rule. Play this situation correctly, especially when you first start.

So what are you supposed to do, if your goal is to withdraw $1000 from your first Funded Account?

IMO, the best approach for newer traders is to stop trading for the day once you cross about $700 profit. Letting a runner hit $1,500 can be easy on an early morning trend while trading NQ futures. But if you do, you will need to earn around $5,000 to meet the 30% consistency requirement.

If you instead stop after about $700-$800 profit per day, you will meet the 30% consistency requirement easily, and be eligible to withdraw with less total profits.

When you’re trying to get your first successful withdraw, both for monetary and psychological motivation, it’s best to get across that finish line as efficiently as you can. Once you are closer to achieving mastery as a trader, you will know when to get aggressive responsibly, and you can plan around this rule less at that point.

30% Unrealized Drawdown Rule

I mentioned this in the Apex full guide, so I won’t elaborate too much here again. Read about it here if you need a refresher.

Profit Withdrawal Thresholds

Next, there are restrictions on how much you are allowed to withdraw.

Before you consider making a withdrawal request, there is a minimum balance required at the time of the request. When you do meet the minimum balance requirement, you are permitted to withdraw only up to $500 from this balance, while the rest of your profits must come from above the threshold. See the table below.

| Apex Trader Accounts | Minimum Balance Required (safety net) | Maximum Withdrawal Amount (first 6 payouts) |

|---|---|---|

| $25,000 | $26,600 | $1,500 |

| $50,000 | $52,600 | $2,000 |

| $75,000 | $77,850 | $2,250 |

| $100,000 | $103,100 | $2,500 |

| $150,000 | $155,100 | $2,750 |

| $250,000 | $256,600 | $3,000 |

| $300,000 | $307,600 | $3,500 |

| $100,000 (Static) | $102,600 | $1,000 |

So if you want to withdraw $1,000 from a $50k account, you need to achieve a total profit of $3,100. $500 can come from the profits up to $2,600, and the other $500 must come from above $2,600.

This is the system in place for the first 6 payouts. No exceptions are made, no matter how much extra money you make.

The system is designed to allow you to withdraw a chunk of your early profits, while proving consistency for a period of time. This restricts reckless gamblers from cashing out an early check and moving on.

Flipping is Allowed Again (part of October 2024 Changes)

Flipping is the act of entering and exiting a trade quickly, often on smaller position size than usual, to add a trading day toward your total. Apex used to have an issue with traders doing this after having a big day, hence the new consistency rules. Now, if you have met the requirements above, including the 5 days with $50+ of profits, and use flipping to get to the 8 total trading days requirement, you can request a payout.

What Happens When Requesting a Payout?

When you have reached the profit requirements, you must go to the website and go to the Payout Request page. You must have reached the withdrawal threshold (safety net), and only $500 of your total payout can be taken from this safety net.

Assuming you follow all of the steps correctly, your payout will be processed within 48 hours, and payment should be sent out within 3-4 business days. You are free to continue trading the same day after it has been approved. This is not always allowed at some firms; some may require you to halt trading until the payout is processed.

Once it’s processed, you will receive your money through whatever service you chose (bank deposit is recommended). You will be free to make another request during the next payout cycle, if you have accumulated another 8 trading days. After 6 of these payouts, you can withdraw as much money as you want from your profits for that account.

If your payout is denied, you will simply not get your money for that payout cycle. You won’t face any consequences for an incorrect or incomplete request, besides having to wait a few more weeks.

Also, keep in mind that if you get a payout denied, and you still have time to request another one for the current cycle, you still have to wait until the next payout cycle.

What if you blow up the account after a Payout Request?

If you make a payout request, and the site says that the request is pending, be very careful not to blow your account up. If you do, you will not receive the money that was requested.

However, if the request says “Approved”, and you blow up your account after, you will still receive your money on the next payment date.

What Happens After A Successful Payout Request?

After your payout request is submitted, you are allowed to continue trading. But you should trade responsibly to ensure that your withdrawn funds are not in risk from those trades.

Keep in mind that it is not your money until the payout has been marked as approved on the payout request page. If you submitted a request and it is still being processed when your balance falls below the payout threshold, it will be denied. For the $50k account, the minimum balance is $52,600 for a payout. If you can trade while keeping your balance above $52,600, you will be fine.

Once the payout is marked as approved, your account display will be changed to reflect the updated balance. Note that the funds haven’t been sent out yet, but they will be sent out regardless of what you do at that point, including blowing the account.

Step by Step Guide to a Successful Payout Request

Much of this is processed automatically, from what I can tell. To hopefully make this process less painful, I will outline it step by step.

1) Meet the minimum account balance and minimum trading days requirements.

This should be obvious by now, but just in case, double check that you have enough profit to make a request. Then, double check that you have traded for at least 8 days, with 5 days showing profits of at least $50. This count resets for each payout, so if you’ve had one before… you probably shouldn’t need to read this tutorial.

To check these values, you’ll have to login to the member page, and you’ll find this information on the “PA Charts” page, available on the main menu to the left.

Note that the “days” value here does not update based on the last successful payout. To verify this, you will have to check your actual trading history through Rithmic or whichever platform has your trading history. Hopefully, you’re tracking all your trades by now and can easily count the days from your own records, but if not, check with your platform.

2) Fill out the necessary Payout Method information.

It’s important to update your profile with the pertinent information in advance. See the left menu again, and click on “Payout Method” which will redirect you to the payout guide in the Apex documentation.

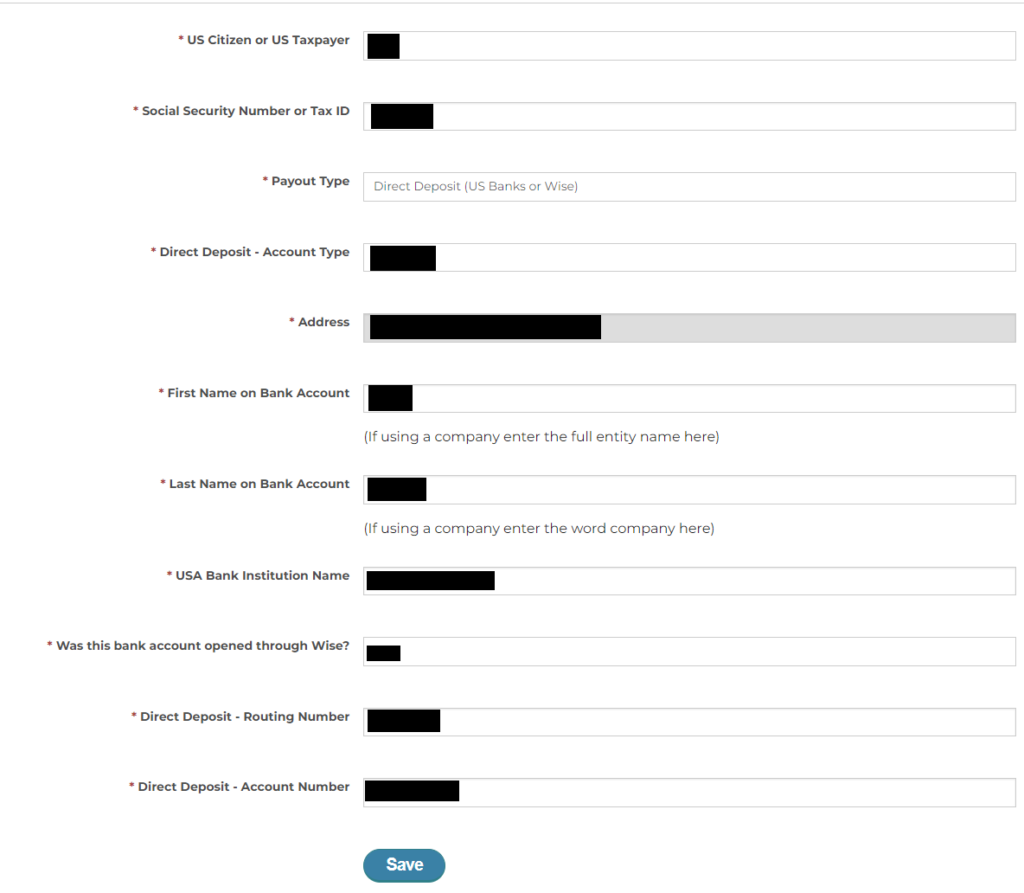

After you click on Payout Method, it will take you to a section of their documentation about payouts. Scroll to the bottom, where there is some large text that says “CHANGE PAYOUT METHOD HERE.” This link will take you to this screen, where you fill in all the necessary information.

I know, it’s an extra step just getting to the form, but that’s just how it is. Maybe they’ll read this and fix it.

After you’ve filled out you information and saved it, you can proceed with step 2.

3) Fill out the Request Payout Form.

Hopefully the information above is correct, or you are at risk of having your request denied or worse, your money being sent somewhere else.

Then, go to this section of the menu.

Select the appropriate account from the dropdown and input how much money you’re withdrawing. If you cannot find your account in the dropdown, it is not be eligible for withdrawal.

4) Wait for your money to be deducted from the eligible account(s). Do NOT make additional withdrawal requests or reach out to the help desk about the submitted request.

Once a Payout Request is submitted, it cannot be changed, edited, or cancelled. This will not change if you submit a ticket to the help desk because you changed your mind. As I mentioned earlier, this process is fully automated, so no one will interfere with it once it is in the system.

I also recommend waiting for the money to be deducted from your trading account before you continue trading. Until it is, if your balance dips too far, it will be denied. Having multiple accounts is a big advantage here, as you can make payout requests and pause trading on one account, while continuing on the other.

If you didn’t meet the requirements, don’t worry. No one needs to be informed of the denial (except maybe your wife/husband), and you will be free to make a request during the next payout cycle if you meet the requirements then.

5) Repeat for each account.

If you have multiple accounts, you will have to fill them out separately here and press the Request button. The good thing is that the maximum withdrawal amount applies to each account individually, so you can actually withdraw a substantial amount of money each month if you’re copy trading across several accounts.

Also, if it makes any difference, the money you request from multiple accounts during the same payout request will be sent to you in one transaction. This is what I was told from Apex support, so I will update this if it’s not true. Let me know if you experience something different.

Conclusion

This should be everything needed to cover withdrawal requests.

I don’t know about any issues specific to non-U.S. traders and the extra steps involved, but it’s worth looking into. If you are reading this in another country, and care to share your experience withdrawing your profits, please reach out and I will add it to this post.

A major advantage of Apex is their frequent sales. Be sure to take advantage of them when they are running something special, as they have done for much of 2024.

Need More?

I’ve listed all the major futures funding companies and their accounts on FundedFilter, and you can see discounted prices there as well. Try comparing Apex Trader Funding with other firms by clicking on the Payouts Tab of any accounts you see there.

Feel free to reach out via Discord if you need more help. Good luck!

Leave a Reply

You must be logged in to post a comment.