Apex Trader Funding has quickly risen up the ranks of futures funding companies. They are now attracting more traders than any other firm for several reasons.

One of their biggest advantages is the frequent sales of up to 90% off of the evaluation cost. Another advantage is the ability to manage up to 20 funded accounts simultaneously. The process of getting funded here is straightforward, but upon getting funding, things can get a bit more complicated.

In this guide, I will show you everything you need to know to get started, and how to work your way up to your first successful payout.

If you are new to the idea of funded accounts, check out this guide to answer all your general questions.

The Evaluation

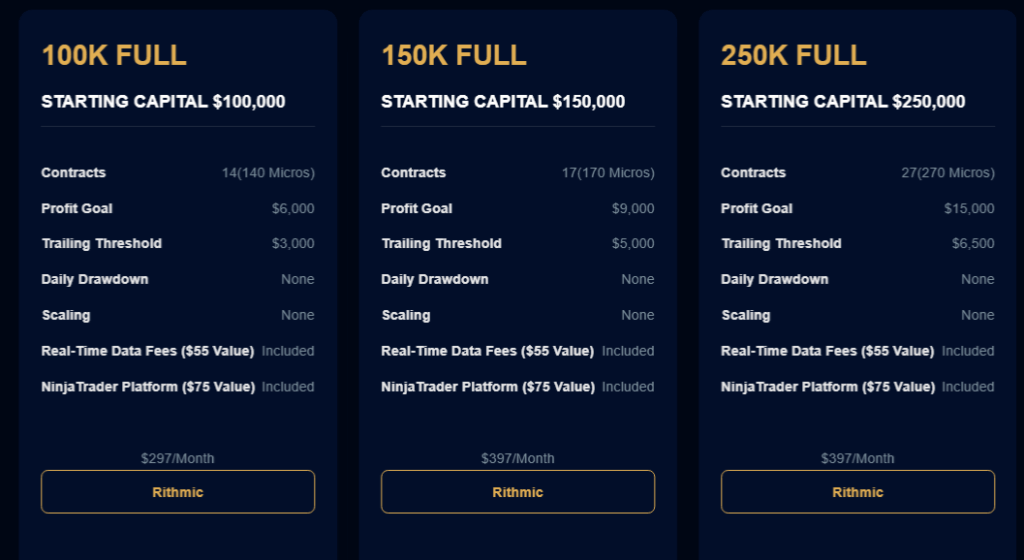

Like most futures funding companies, Apex offers a variety of account sizes and plans to choose from. In addition to 8 separate account sizes, they are also separated by trading platforms: Rithmic, Tradovate, and the newly added WealthCharts. I use Rithmic for everything, but I’ve heard good things about Tradovate too.

If you opt for Tradovate, the account plans will be the same as with Rithmic, but cost $20 extra. WealthCharts accounts are the same price as Rithmic.

See the account sizes below, and note the additional $20 cost on Tradovate plans.

WealthCharts

I almost exclusively go with the $50k plans with Rithmic. They are the best value for the cost, and more than enough size and drawdown to do well with.

If you have the capital to go with a larger account, the $150k account is better than the $100k, and the $250k is powerful as well. Neither are evenly scaled up from the $50k when it comes to drawdown or contracts though, so if you’re on a budget, go with the $50k to start.

You can compare all of the different account sizes and costs (even across firms) here. Alternatively, try my new app FundedFilter for a more visually aesthetic comparison tool.

Signing Up For the Evaluation

When you want to sign up for an account, you can do it in two ways.

- Select an account size from the main page (with the buttons marked “WealthCharts”, “Rithmic”, or “Tradovate”).

- Or, register your own account (with the yellow “Sign Up” button at the top right of the home page). Log in, and find the appropriate WealthCharts, Rithmic or Tradovate account from the navigation menu on the left of the member page.

Either way, you will be redirected to a page like this.

The payment option you select doesn’t matter, but the coupon code does. If you don’t enter a value here, you will be charged full price for the evaluation.

As mentioned earlier, one of Apex’s biggest advantages is that they hold frequent sales of anywhere from 70-90% off on everything. The current sale will be applied to your evaluation cost when you fill out the box accordingly. If there’s a sale going on and you don’t use a coupon, you will not be able to get a discount later.

After taking some time to read through the various Terms, Disclaimer, and Privacy Policy sections, and double-checking that you’ve selected the right account plan, proceed to the payment page.

Double check again that you have selected the right account and not the wrong platform, and fill out your information to pay for the account. Also, double check that your discount was applied – don’t submit the payment if you forgot to use a coupon code! There is no reason to pay full price when you can always get at least 50% off by using our code.

After a short time, you will receive an e-mail and your account will be set up for you to start trading the same day. As with all subscription-based evaluations, once it’s been paid for, the clock starts ticking.

Rules of the Evaluation

To pass the evaluation phase, you have one objective: produce a certain amount of profit relative to the account size.

There is a minimum 7 trading days requirement, which means you simply have to place at least one trade per day, for 7 days. If you have a strategy that can capture just 20-30 points per day on a single e-mini contract of NQ, or 8-12 points on ES, you should easily pass the evaluation in those 7 days.

If you prefer to trade micros or your strategy takes a bit longer, there’s no rush. You are allowed to take as long as you want, and should take the full month if it means ensuring that you will pass. Just keep in mind that each additional month will be billed again, as the accounts are subscriptions and not single payments.

Trailing Drawdown on Hell Mode

The trailing drawdown during the Apex evaluation is the worst one you’ll find in the world of funded futures. The typical trailing drawdown, which is the second most difficult variation of the drawdown, moves up as you grow your account balance. This includes unrealized profits, and it moves up until it reaches the initial balance. It doesn’t go back down if you take losses, but if you stay well above your initial balance, you’ll typically be fine.

But during the Apex evaluation phase, this drawdown will continue to rise beyond the initial balance, which is something you don’t typically see.

So if you chose the $150k account, and have a large unrealized profit, be extra careful. Your profit might be $8,000, putting your account balance at $158,000. But because your max trailing drawdown is just $5,000, your new auto-liquidate threshold will be at $153,000. So if your position drops by $5,000 at that point, you fail your evaluation despite having $3,000 of profit.

This rule does not apply to funded accounts; once funded, the drawdown will stop at the initial balance +$100.

Trading Programs, Bots, and Copiers

Apex allows and even recommends trade copiers, but they do not allow fully automated trading. The trader must be watching the screen if there is a program used to help place trades.

Passing the Evaluation

After trading the necessary number of days, and meeting the profit requirements, you don’t have to do anything. Simply stop trading and wait.

The accounts are automatically evaluated at the end of each trading session, and you will get an e-mail if your account has passed. Your subscription will be cancelled and you will be sent a link where you are able to sign your contract. There is also an activation fee for each account, which you can see in the table below.

Note that this process can take up to 2 business days, but is usually done the same day you pass. If it’s taking longer than 48 hours, you may need to reach out to Apex. They will manually cancel your subscription and set up the funded account soon after.

| Apex Trader | Monthly Fee (Rithmic) | Waiving Rithmic | Monthly Fee (Tradovate) | Waiving Tradovate |

|---|---|---|---|---|

| $25,000 | $85 | $130 | $105 | $150 |

| $50,000 | $85 | $140 | $105 | $160 |

| $75,000 | $85 | $180 | $105 | $200 |

| $100,000 | $85 | $220 | $105 | $240 |

| $100,000 (Static) | $85 | $220 | $105 | $240 |

| $150,000 | $85 | $260 | $105 | $280 |

| $250,000 | $85 | $300 | $105 | $320 |

| $300,000 | $85 | $340 | $105 | $360 |

The Funded Account

Now that you’re funded, there’s some extra rules you have to abide by that weren’t enforced during the evaluation.

Funded Account Rules

Similar to many other firms, the evaluation is more lenient on contract sizes, consistency, and news releases. Apex has historically enforced most of their rules with discretion, but it’s not a good idea to see just how much you can get away with here. You will run the risk of having payments denied if you are doing something insane with your funded account, even if you made a lot of money with it.

50% Scaling Rule

Apex introduced a 50% scaling rule in the end of October 2024. This new rule says that you must trade no more than 50% of the maximum account position size, until you have crossed the withdraw threshold for that account. On a $50,000 account, this threshold is at $2,600. Because you get 10 contracts max, you must trade no more than 5 contracts until you have made at least $2,600.

Considering how much 5 e-minis will make you on a single trade, this is not much of a restriction.

Consistency on Contract Sizing

Apex applies some discretion with regards to contract sizing. Just use some common sense and don’t randomly vary your trade position sizes. By trading 2 contracts per trade on Monday, and then 8 per trade on Tuesday, you are showing a poor understanding of risk management. This will rarely work out in the long term, and will likely be flagged when you request a large payout.

Since no experienced trader randomly switches size dramatically, this is not much of a restriction.

Consistency on Profits and Losses

Apex has a 30% consistency rule, which says that you must not have a single day’s profits exceed 30% of the total profits of the current payout period. If you are using a lot of contracts haphazardly, it’s possible that you will end up with a massive profit (or loss) on one day, with small profits and losses on other days. Apex will take a closer look at your trading history if you have any suspicious activity like this going on.

To play it safest, simply trade the same size, and don’t go for 5 home runs in a single day. If you have a single runner earn you a significant profit, consider stopping early and resuming the next day to make the withdraw process easier on yourself.

You are liable to have payouts denied by violating this rule, but you can simply continue trading until you fall under that 30% mark.

30% Maximum Unrealized Drawdown

The Maximum Unrealized Drawdown (which I will call MUD) rule applies to the drawdown you face in open positions. If you have not yet reached the withdraw threshold, you must not risk more than 30% of your maximum trailing drawdown. On a $50,000 account, the drawdown is $2,500, which means you should not have a $750 unrealized drawdown in any single position.

Note that this only applies to a single open position – it is not a total daily loss limit. So if you are taking multiple separate losses that result in a greater than 30% loss, you are not breaking this rule.

When you do cross the withdraw threshold, you must use 30% of your total profits when calculating your maximum unrealized drawdown.

For example, let’s say you’re on the $50,000 account, and you’ve earned $3,000 profit so far. This means that you’re past the withdraw threshold of $2,600, so you must use your total profits for calculating your MUD. Take $3,000, multiply it by 0.30, and you get $900. Just make sure that a single open position doesn’t go against you by $900 or more, and you will be fine.

If you do happen to cross the withdraw threshold, and fall back within the safety net, you go back to using the maximum trailing threshold for calculating this unrealized drawdown.

And as mentioned earlier, this applies to a single position only. If you take 4 separate trades that each cost you $250, totaling $1,000, you would not be violating this rule.

Maximum Risk to Reward Ratio

Apex loosely enforces a rule on your risk-to-reward ratio. You must not risk more than 5 times your profit target during your trades. In other words, don’t use a wide stop which risks more than $500 to hit a $100 profit target. If you have a good strategy, this should not affect you at all.

News Releases

Apex, unlike many other firms, does permit holding positions through news releases. However, they do not permit taking trades strictly around news releases (essentially gambling).

For example, if you had a decent setup appear 10 minutes before a news release, and you know it will work out for you based on your strategy and data, you are fine to hold your trades. By trading the same size you normally do, and placing your trades, take profits, and stops as normal, this is accepted at Apex.

But if you notice a news release is about to come, and you load up with large size and put a wide stop and wide profit target, aiming to quickly get a fill and a big profit, they may deny a payout due to this, or worse.

Outside of this, Apex will not instantly fail you the way some other firms will. Still, I advise against it until you are truly an expert with news releases.

Withdrawing Profits From Your Funded Account

At Apex, traders get to keep the first $25,000 of their withdrawn profits, per account. After this, traders get 90% of their profits, and Apex keeps 10%. But before you can get your first $25,000 there’s a few things to understand about how withdraws work here – it’s not the most simple system out there.

No matter what account size you’re on, you must have 8 trading days before you can request a payout. In addition, there is a profit threshold (or safety net) that you must meet before you are eligible to withdraw, and a minimum/maximum you are allowed to withdraw for the first 6 payouts.

Once you do have 6 payouts, you will still need 8 trading days for future withdraws. But the maximum withdraw cap will be removed, and you can start printing money like never before.

See the table below for the withdrawal minimum balance and maximum amounts.

| Apex Trader Accounts | Minimum Balance Required (Safety Net) | Maximum Withdrawal Amount (first 6 payouts) |

|---|---|---|

| $25,000 | $26,600 | $1,500 |

| $50,000 | $52,600 | $2,000 |

| $75,000 | $77,850 | $2,250 |

| $100,000 | $103,100 | $2,500 |

| $150,000 | $155,100 | $2,750 |

| $250,000 | $256,600 | $3,000 |

| $300,000 | $307,600 | $3,500 |

| $100,000 (Static) | $102,600 | $1,000 |

At other firms that use the withdrawal threshold system, you must leave that much money in the account indefinitely. At Apex, if you meet the minimum balance requirement, you may take a maximum of $500 out of your safety net profits. If you want to withdraw more, you must take it from profits above the safety net.

So if you’re on a $50,000 account, and have generated $3,000 of profits (while meeting the trading days/consistency requirements), you are eligible to withdraw up to $900. $500 comes from the threshold amount of $2,600, and then $400 comes from the profits above $2,600.

I’ve written an extensive breakdown on withdrawing profits from Apex here.

Apex Trader Funding Compatible Platforms

If you are on Tradovate, it can only be used on Tradovate Web/Mobile, TradingView, or NinjaTrader Desktop/Mobile.

When you choose Rithmic, there’s 14 platforms you can use with it. NinjaTrader 8 (no NT 7) is the preferred platform at Apex, but I personally use Quantower and R Trader Pro.

RTrader Pro, Rithmic Trader Pro Mobile, Rithmic RTrader Pro-Web

WEALTHCHARTS Web Based

Conclusion

Overall, Apex Trader Funding provides an amazing opportunity for futures traders, with plenty advantages and no major drawbacks to cause any real issues. If you go with Apex, try to take advantage of their sales.

Traders here seem to make much more money than I’ve seen at any other firms, largely due to the ability to have 20 simultaneous funded accounts. If you follow the rules and scale responsibly, there is almost no limit to the upside.

I will be adding a full review of my experience so far at Apex, which I will link here soon. I have prepared a separate guide to the entire withdraw process here.

Any questions or feedback? Leave a comment, or let me know via Discord!

My Guides to Other Futures Prop Firms:

Leave a Reply

You must be logged in to post a comment.