Phoenix Trader Funding is a firm that offers 3 types of evaluation accounts for futures traders. The one I decided to try is called the Merit account, which is a unique evaluation, unlike any others.

This account was offered in 4 sizes. Since then, they have removed 3 of the 4 account sizes, leaving just the $100k account option. See the previously available accounts below.

| Phoenix Trader Funding Merit Accounts | Contracts | Cost |

|---|---|---|

| $5,000 (Not available) | 5 micros | $5 |

| $10,000 (Not available) | 1 (10 micros) | $10 |

| $50,000 (Not available) | 2 (20 micros) | $20 |

| $100,000 | 3 (30 micros) | $40 |

In this post, I will go through everything about the Merit Account, and my experience trying it.

What is the Merit Account?

Phoenix Trader Funding offers the Merit Account as a way for traders to go from an evaluation straight to a live brokerage account in a single step.

The Rules

As mentioned earlier, there are basically no rules with regards to trading style or frequency. But there are a few things you do have to follow, listed below.

- You have a maximum contract size, which you cannot exceed. On the $100k account, it’s 3 minis, or 30 micros.

- There is a static drawdown equal to the full account balance. Until you lose 100%, you can continue trading.

- You must trade for a majority of the month to adequately display your trading ability. A calendar month typically has 22 trading days, so you should aim to trade for at least 15-18 of those days. You do not have to trade a lot, however, and can place one trade per day if you like.

- You cannot hold positions overnight, as is the case with most funded futures accounts.1

- You can only have one merit account at a time. “On your first purchase, other Merit accounts will be deactivated, and you will no longer be able to acquire them.”

How You are Evaluated

Not every trader will receive a live account upon completing the evaluation. But if there’s no profit target, how do you even pass?

Phoenix says that they will evaluate your trading based on these factors. While you have the full account balance to play with, you should do your best to demonstrate that you are capable of managing your risk and taking good quality trades on a consistent basis.

Since the time that I completed mine, Phoenix has removed all of the Merit Accounts except their largest one, the $100k. Their reason is that there are just too many downsides with limited upside for the company.

Traders who do poorly or do not get accepted tend to leave negative reviews, even though they got exactly what they paid for with the evaluation. Traders who do well enough will receive a live funded account, and likely a loss generated for Phoenix if that trader then blows up the account. The only way this works out in their favor is through a funded trader producing significant profits, which are then split with the company.

It’s a lose-lose situation, and so you can’t really blame them; however, it’s still a bit of a disappointment as an experienced trader.

Passing the Merit Account

To pass the Merit Account, you simply have to trade well. There’s no objective metric that us traders know of, and besides a vague reference to consistency, Phoenix is keeping this a secret for now.

Note that Phoenix even mentions that profiting more doesn’t necessarily mean you will pass. They are likely more interested in how you manage your risk, alluded to in this note:

“Just because you only have 30 days does not mean you have to maximize your profits. We can deny funding to someone who has generated $30,000 and give it to someone who has generated $500.”

I am guessing that your consistency will be measured similar to how firms have a % consistency rule, and if you are showing the majority of your profits in a single day, this will count against you.

My $50k account came with a maximum size of 2 e-minis, so there wasn’t much opportunity to radically change contract sizes in a way that it would hurt my legitimacy. But I’d still recommend trading the same size throughout the month for smoother results.

The Live Account

After passing, you receive a live brokerage account, with a small initial balance. For the $50,000 account, it is a $2,000 balance, with the same contract size of 1-2 e-minis (10-20 micros).

Profit Split

Today, most prop firms now offer a 90/10 profit split, with some still lagging behind at 80/20 or worse. Phoenix Trader Funding offers a 90/10 split on their normal funded accounts with the first $10,000 going to the trader.

In the Merit account, however, it works differently. After getting the live account at a significant discount, traders get a 50/50 split at first. Once they reach a payout of double the account’s balance, the split is changed to 80/20.

For example, if you pass with the $10,000 account, you receive a live balance of $1,000. When you request a payout of $2,000, 50% of this goes to the firm, recouping their initial investment in you. After this, you receive 80% of all profits. With no restrictions on withdrawals in terms of trading days, minimum or maximum profits, this seems like a pretty good deal for such a small initial investment.

Account Fees

While the Merit evaluation has only a single one-time fee, data fees are charged monthly once you transition to the live account. This fee is $135/month per exchange. The small upside is that this is billed directly to the account, so it won’t come from your pocket.

Failing the Merit Account

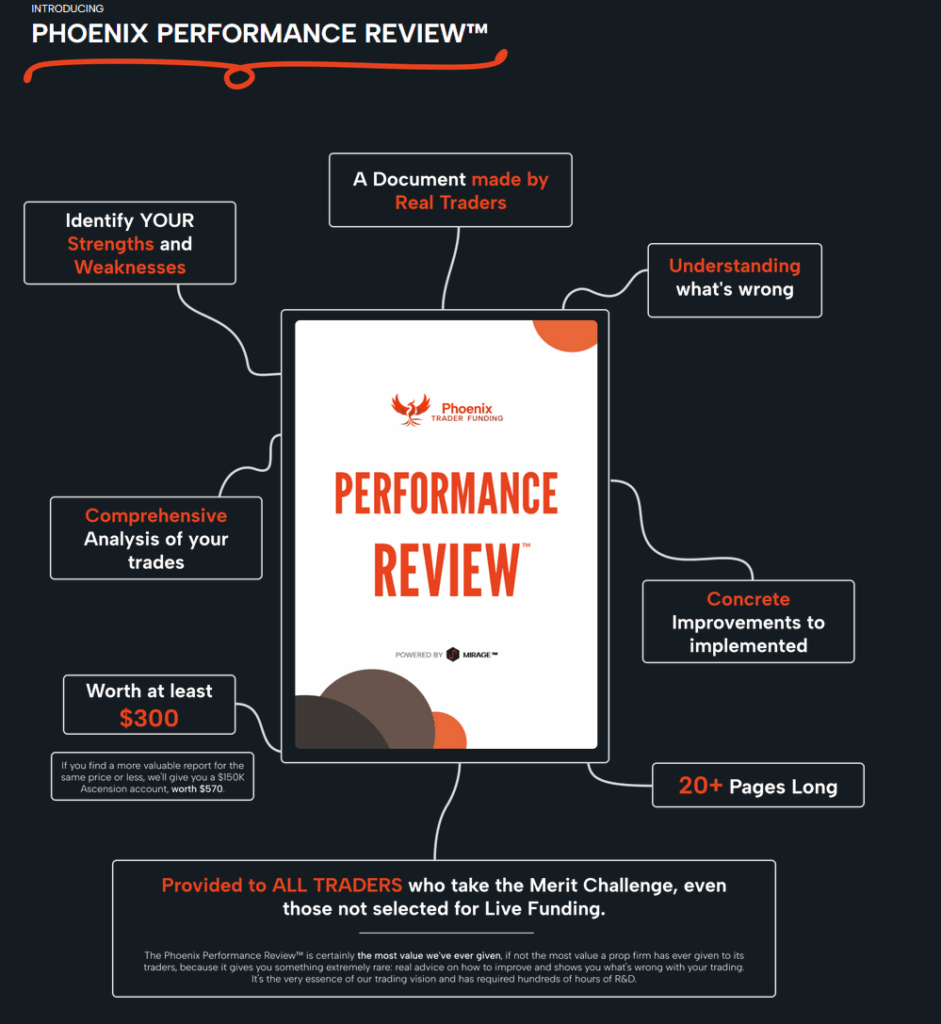

If you break a rule, or simply don’t have a good enough month, you still don’t leave empty-handed. Phoenix promises a 20 page comprehensive review of your trading for the month.

For a trader looking to improve, this may provide some insight regarding some of your trading habits or mistakes you may be overlooking.

Phoenix also says that if you can find a similar report for less, they will gift you a $150k Ascension account, which typically costs $570. Considering no other firms offer any sort of performance review, at least not that I’ve seen, it’s safe to say nobody is receiving the free Ascension account.

Still, for beginner traders, this could be helpful, and so it does have some value. I was able to see what one review looked like, and it contained:

- An Executive Summary

- Day by Day Performance Calendar

- Overall Performance Review

- Profitability Analysis

- Risk Management Evaluation

- Trade Management & Execution

- Performance By Instrument & Symbol

- Long Vs Short Performance

- Performance By Days & Hours

- Performance Of Your Stop Orders

- Peer Analysis

- Tilts

- Martingales

- Your Trader Category

- Areas Of Strength

- Areas Of Improvement

- Key Upgrades For Immediate Focus

- Conclusion & Next Steps

If you’re already tracking your trading properly with a good trading journal (or just Excel/Google Sheets like me), you may have already seen some of your stats. But being able to see how other traders are doing could be interesting.

It’s worth noting that some or most of this report is AI-generated, and it is not proofread as well as I would have liked it to be. I noticed several typos and misspelled words, which makes it seem a bit rushed and unprofessional. Regardless, having all of your main metrics in one place could help you perform better on your future evaluations.

If you’re looking for futures accounts that do permit overnight holding, check out FundedFilter and use the Overnight Trading filter on the left panel. This will show you every account that permits some form of swing trading.

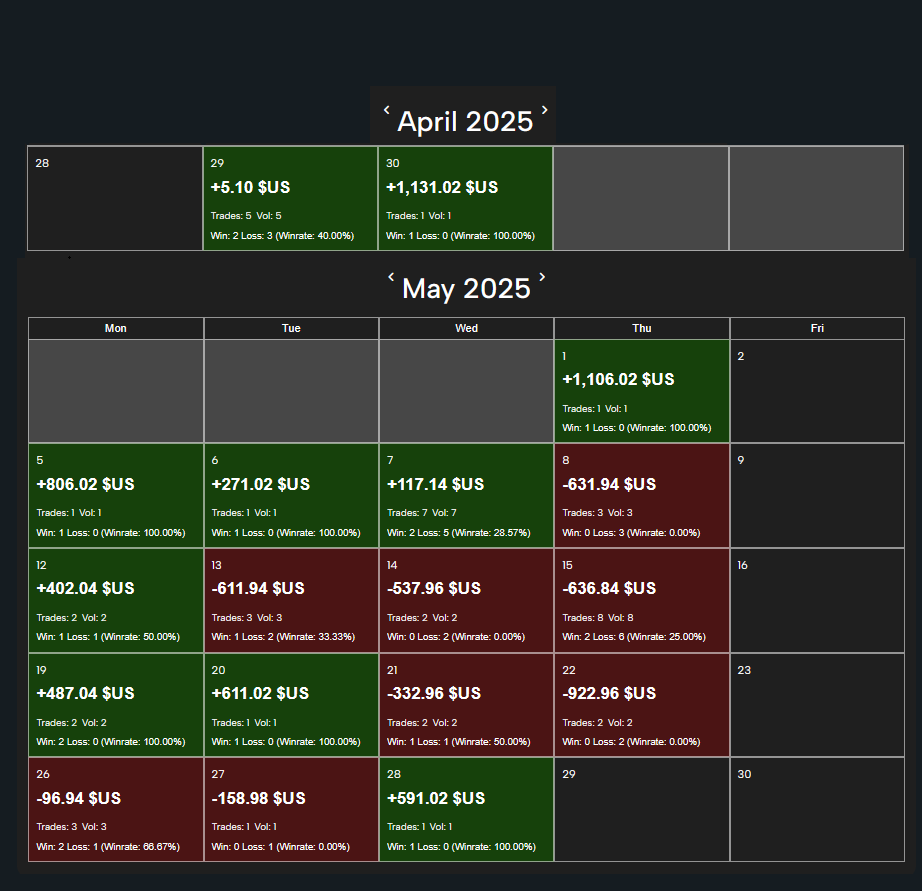

My Merit Account Evaluation

I completed my full month of trading in May, starting from the last day of April. The accounts were quite cheap, and I chose the $50k evaluation for just $20 (plus $0.60 tax). In this post, I will go through everything about the Merit Account, how I did, and what happened afterward.

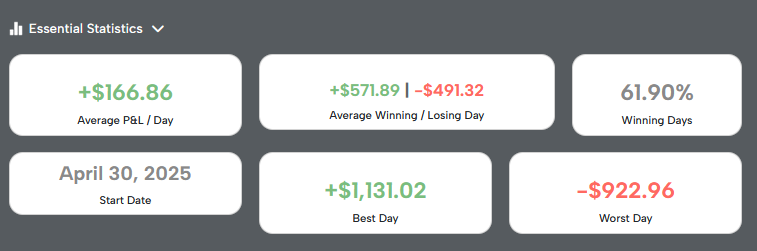

During my month, I traded at least once every single day, and finished with a net profit of $3,504. I started off by making about 6% ($3,200) in the first week, and slowed down considerably afterward. While splitting my focus between the Merit account and my other funded accounts, I felt I underachieved and lost some of my rhythm in the middle of the month.

Still, a 7% profit overall without having any significant losses, I felt my chances were good.

The Unexpected Delay

Some say it takes a few days to get your account reviewed and processed during this challenge. But it’s taken much longer for me. After completing my account on May 30, the website updated and said my account was being looked at, and nothing happened for at least 10 days.

I e-mailed Phoenix Trader Funding about it, and opened a ticket on their Discord server just in case.

I got a response from the CEO, asking me some questions regarding my trading background and the strategy I use. After sending my response, another week passed, with no follow up.

I will update this when I have more information.

Edit: June 24, still waiting.

Edit: July 2nd, still waiting.

Edit: July 9th, still waiting.

If you’d like to try the Merit Account, it’s still available in the $100,000 size now. But at just $40, it’s a great way to test your strategy fully without the pressure of a trailing drawdown or other common limitations. Getting a Live account (if you pass) will be a valuable asset in your portfolio of accounts.

I will consider a Phoenix Classic or Ascension account based on how I feel regarding the experience in the Merit Live account. If you have any questions or need some help regarding your challenge, feel free to reach out or find us on Discord.

Leave a Reply

You must be logged in to post a comment.