I had a slightly better day but it was still bad overall, with way too many trades again. Every one of those unnecessary trades ends in a loss because they typically start with a low quality entry.

Pre-Market Prep

Recognized 1H as divergent, stayed ready for a mountain reversal.

News

7:00: FED Testifies. Barely moved, high not corrected but inconsequential.

Market Open

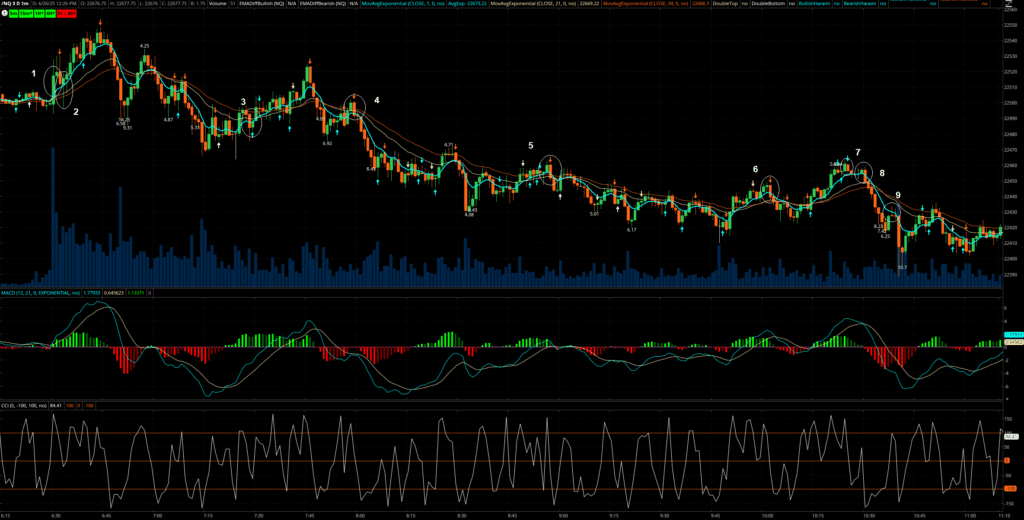

Overall trends bullish, but 1H bearish divergence and Daily a little overextended. 5m made an easy setup on the open due to lack of reversal candles, and 15m was clearly stacked, so despite the slowness, it was an easy opening run.

Goal for the Day

The main goal for today was to reduce overtrading habits from the previous day.

The secondary goals were:

- No Overtrading

- Work on Accounts 50, 51, 52, 25 primarily.

- Execute one good 15+ point trade on OneUp Eval

Trades for the Day

I took too many trades, despite the fact that the overall read on the way down was correct.

- 6:30: Recognized the market would go through highs without a setup, and took it on OneUp. Held through retrace almost to lows, and trusted the HTF despite the tricky bearish engulf signal. Got +29 points on OneUp.

- 6:33: Jumped in long with the recovery candle on #25, but got greedy and sized up which was unnecessary for that account. Ended up cutting it for the sake of discipline, correct decision.

- 7:29: Not a valid MV setup, as it’s a harami, but felt strongly that it would break 516. Ended up cutting the trade early due to stall, but it was a right read. Not a necessary trade to take nonetheless.

- 7:59: Excellent read and execution of 1m 34, got the low break and got out. Slight mistake in recognizing the 5m low break was coming at the same time. Cost me about 10 extra points.

- 8:57: Correctly read the 1m wave, but then overmanaged and doubted myself on the recovery. Went short 3 times in the same move on the same account, just refusing to trust myself fully when it stalled. Increased size and ultimately exited just before the full dump came.

- 10:03: Too eager, jumped in on a bad 1m bearish engulf. Didn’t exit when bullish hammer signaled to get out, and lost profits immediately.

- 10:25: Read 5m 34 setting up before the signal came, but doubted myself. Exited, re-entered, took 15 points on a bounce despite no bullish reversal signal, and then re-entered short yet again on another account. Low break was 383, got greedy and wanted exactly that, but the move was sharp and sudden, and stopped at 388. Got out in the end around 407. Good recognition to get back in, but bad idea to expect perfection on the low break in this market action.

Progress

Recognized the 5m 34 at the very beginning, took it with the right read on the target. Executed two very good trades overall.

Also correctly recognized the 15m would finish a mountain reversal, despite how long it took.

Problems

I did not do better at limiting overtrading, as #51 end up -40 points overall. Took around 11 trades today, which is ridiculous for a day that only gave 4 A+ setups. Also did not do a good job of trusting the A+ 5m 34 when it came, as a result of fatigue from earlier mistakes.

Managing the 5m 34 needs to be much better. I am being too impatient while the market is slow.

Goal Results

- Still too many unnecessary trades.

- Slight progress on #50, #25, but multiple steps back on #51, #52.

- +29 poitns on OneUp Eval Day 1 ($580/$3,000)

Goals for Tomorrow

Tomorrow is Friday, and it will likely not be as easy as today was. I aim to continue to stay patient and disciplined like I was today, regarding where I find my setups.

Goal #1: No overtrading. High quality entries or skip the trade.

Goal #2: Try to fix Account #51, trade MNQ if necessary.

Goal #3: Work on Accounts 50, 52, 54, 25.

Goal #4: Add 10-20 points on OneUp eval.

Final Thoughts

I am disappointed in the lack of progress with overtrading, as I was still too eager to jump into some moves today. I put one account deep into the red by taking multiple poor quality short entries because of my conviction that it would go lower. Entries matter the most, and I let that slip my mind somehow. I also did a poor job of pausing between trades to reduce the likelihood of overtrading, and the results are self-explanatory.

The overtrading led to mismanaging the best short when it finally came. Overall the day is negative but it’s mostly one account that is now in bad shape due to the overtrading. I will focus on that tomorrow. By my standards, only 2 good trades out of 11, and only one was actually executed fully.

Leave a Reply

You must be logged in to post a comment.