If you’re struggling with minimizing your losses during a prop firm evaluation or funded account, don’t worry. It’s a common struggle for many traders when first learning to trade. But if you feel like nothing is helping, this may help.

Several prop firms impose a Daily Loss Limit on evaluations/funded accounts. Depending on the company, violating this limit either stops you from trading for the day or completely fails your evaluation/funded account.

But if you’re trading your own account, or working with a firm that doesn’t use a Daily Loss Limit, you may find yourself wishing you had a way to stop yourself from trading once you make too many errors on one day.

As a trader, managing your risk and more importantly, your mental edge, is vital to long term success. The good news is that several firms work with Rithmic connections, allowing you to use R Trader Pro to set some extra limits on your account, even if the firm doesn’t require them.

How to Set it Up

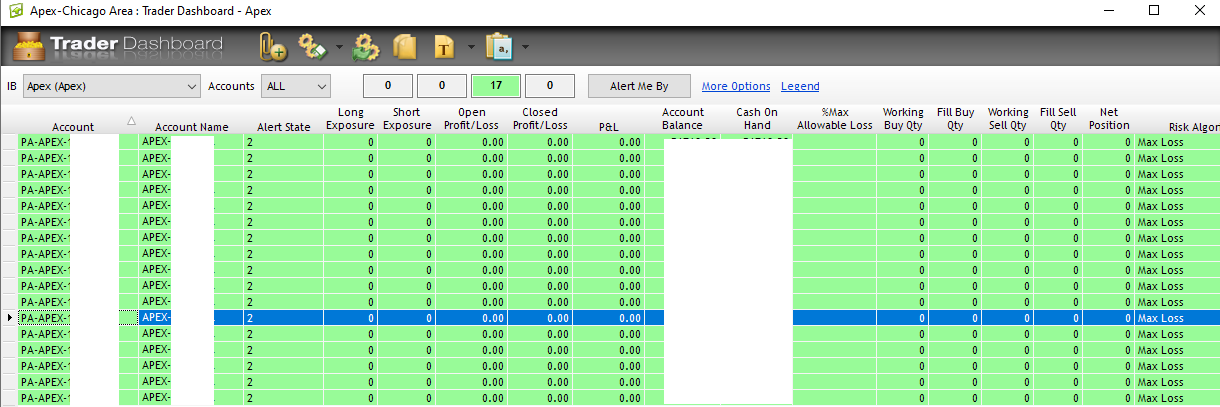

I will assume you already have R Trader Pro, but if you don’t, download it here. Once you log in, click File, and go to Trader Dashboard.

Here, you can see all your accounts in one place along with some parameters and the balances on each. Right click the account you are trying to add a limit to, and click Risk Parameters.

This screen will pop up, and it has 3 tabs. Click the tab that says “Risk Parameters set by the Trader”.

Along the top of this tab, you can see some columns that say Auto Liquidate, Auto Liquidate Criteria, etc.

Click on Auto Liquidate, and a drop-down allows you to select Enabled/Disabled. Select Enabled.

Then, click on Auto Liquidate Criteria, and the drop-down menu offers multiple options for what kind of auto-liquidate system you want. Select Loss Limit.

In the next column, Auto-Liquidate Threshold is a text box, where you can enter the dollar amount you want to apply. If you enter $400, it means that your positions will automatically get closed as soon as your account balance touches -$400 on the day, unrealized losses included.

Finally, click Apply in the bottom right on the screen, and you’re ready to trade with a new Daily Loss Limit. That’s all there is to it.

Keep in mind this has nothing to do with the firm you’re working with, as the account’s failure only depends on the firm’s rules. But if a firm says they will fail you for losing $1,200 in a day, having an auto-liquidate threshold at around $1,000 or even less may be a great way to keep you in the game long enough to succeed.

Warning: Positions Will Still Open

One slight issue with this setup is that if you get auto-liquidated by your new DLL, it doesn’t stop you from placing new trades with that account. Your new position will your open, and the auto-liquidate will immediately close it, typically costing you 1-2 ticks and commissions. This is a bit annoying, as every extra loss adds up, but there’s a solution to that too.

If you would like to completely stop any new positions from opening, regardless of your DLL, you can lock yourself out of an account on R Trader as well. Simply right click the desired account from the list on the Trader Dashboard, and check this box.

I don’t think this option auto-enables when you are auto-liquidated; if it does, it wasn’t happening for me. But by checking it here, it will immediately stop you from trading more on that account. Then, uncheck it when you’re ready to continue.

Having a system like this in place to automatically stop you from trading can make a big difference for a beginner trader. It can feel frustrating having to stop trading at times, but keep in mind that your long term success depends on building good habits. Trading more on a day where you start off poorly is not worth potentially blowing an account.

Good luck, and stay disciplined.

Leave a Reply

You must be logged in to post a comment.